How to Finance a Japanese Import Van in Australia – Complete Step-by-Step Guide

23:17 27/08/2025Why Australians Choose Japanese Import Vans

Japanese vans like the Toyota Hiace and Nissan Caravan have gained massive popularity in Australia. They are known for:

Reliability: Built with durable engines suitable for long-distance driving.

Fuel efficiency: Lower running costs compared to many European vans.

Versatility: Perfect for trade work, deliveries, or as a base for campervan conversions.

Resale value: Strong demand ensures good resale prices, particularly for Hiace vans.

Step 1: Understand the Import Process

Before thinking about finance, it’s important to understand how Japanese vans are imported into Australia.

Import Approval

The van must comply with the Road Vehicle Standards Act (RVSA). Importers usually handle this paperwork, ensuring compliance with safety and emissions standards.

Shipping and Compliance Costs

Beyond the purchase price, you’ll need to cover:

Shipping fees

Import duty & GST

Compliance modifications (e.g., seatbelts, lighting, emissions testing)

A trusted dealer like Commercial Motor Group usually includes compliance costs in the sale price, which simplifies financing.

Step 2: Explore Finance Options

1. Bank Car Loans

Banks offer secured and unsecured car loans.

Secured loans (lower interest) use the van as collateral.

Unsecured loans (higher interest) rely on your credit profile.

2. Dealer Finance

Dealers specialising in Japanese imports often partner with finance companies. Benefits include:

Quick approvals

Packages tailored for imports

Flexibility for trade businesses

3. Chattel Mortgage (For Business Owners)

A popular option for tradespeople buying commercial vans.

You own the van immediately.

Interest and depreciation are tax-deductible.

4. Leasing & Hire Purchase

Leasing allows you to drive the van without full ownership.

Hire purchase spreads costs with eventual ownership at the end of the term.

Step 3: Prepare Your Finances

Check Your Credit Rating

A strong credit score can help secure a lower interest rate. Obtain your credit report before applying.

Save for a Deposit

Many lenders prefer a 10–20% deposit, especially for imported vans.

Calculate True Costs

Beyond repayments, factor in:

Insurance (may be higher for imports)

Registration fees

Servicing & spare parts

Modifications (e.g., 4WD upgrades or camper fittings)

Step 4: Choose the Right Van to Finance

Toyota Hiace – The Workhorse

Perfect for trades, couriers, and families. Available in standard and 4WD versions.

Nissan Elgrand – Luxury People Mover

A popular choice for families and long trips.

Mitsubishi Delica – Adventure Van

Favoured for off-road and camping lifestyles.

You can explore reliable options at Commercial Motor Group’s Japanese import collection.

Step 5: Applying for Finance

Documents You’ll Need

Proof of income (payslips or tax returns)

Identification (driver’s licence, passport)

Bank statements

Details of the van purchase agreement

Application Timeline

Submit documents to lender

Receive pre-approval

Finalise purchase with dealer

Loan settlement and van delivery

Common Mistakes to Avoid

Underestimating costs: Forgetting insurance and compliance fees.

Not comparing lenders: Rates vary significantly.

Rushing into dealer finance: Convenience is tempting, but independent loans may be cheaper.

Ignoring resale value: Choose a van with strong demand, like the Toyota Hiace.

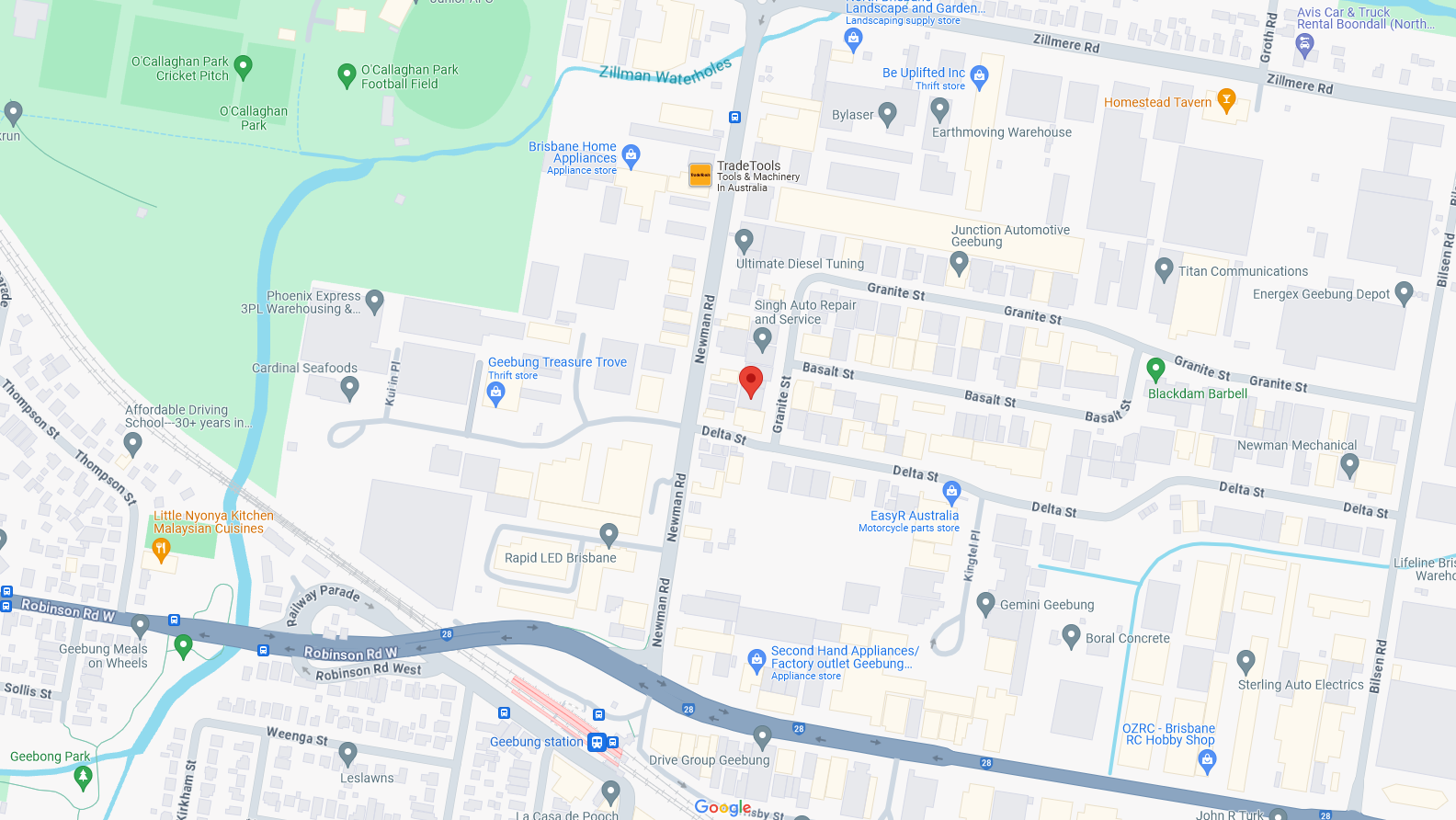

Case Study: Financing a Toyota Hiace in Brisbane

John, a tradesman in Brisbane, purchased a 2017 Toyota Hiace import.

Price: $34,000

Deposit: $6,000

Loan: $28,000 over 5 years

Monthly repayments: ~$520

He used a chattel mortgage, enabling tax deductions on repayments, saving him thousands annually.

Tips to Secure the Best Finance Deal

Get pre-approval before visiting the dealer.

Negotiate both loan terms and van price.

Ask about balloon payments (large final payments that reduce monthly instalments).

Use the van for business? Claim tax benefits!

Where to Find Japanese Import Vans in Australia

For quality and reliability, check trusted sellers like:

Frequently Asked Questions (FAQ)

Q1: Can I get finance for any Japanese import van in Australia?

Yes, but it depends on the lender. Some restrict financing for certain models.

Q2: What’s the best finance option for business owners?

A chattel mortgage is often best, thanks to tax benefits.

Q3: Is financing an imported van harder than a local one?

Not if you work with a lender experienced in imports. Dealer finance can simplify approval.

Q4: Do I need a bigger deposit for an imported van?

Some lenders request higher deposits (10–20%), but flexible plans exist.

Q5: Can I finance a van I plan to convert into a campervan?

Yes, many lenders allow this. Just ensure you disclose your intended use.

Hiace 4WD Campervan vs Motorhomes | Which Is Better for NSW & QLD Travel?

Hiace 4x4 Off-Road & Campervans for Sale in NSW and QLD | Motorhomes Australia

Hiace 4WD Campervans & Motorhomes for Sale in NSW & QLD | Toyota Hiace Specialist

Motorhomes for Sale in NSW & QLD | Hiace 4WD & 4x4 Off-Road Campervans

Best Mining Fit-Out for Toyota Hiace in WA – Work-Ready & Remote Approved

Hiace vs LandCruiser for Mining Support Vehicles in WA – Which One Makes More Sense?

Toyota Hiace 4WD for Sale in WA – Mining & Off-Road Ready

Toyota Hiace for Sale in WA – Built for Mining & Remote Work

Best Toyota Hiace Setup for Off-Grid Campervan Living in Australia

Toyota Hiace 2.8L Diesel Engine Problems, Reliability & Maintenance Guide